City Of Regina Property Tax Exemption Program . the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. the bylaw provides a tax exemption for the years 2020 to 2024 for the property located at 5380 parliament avenue, regina, sk. The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification. 34 organizations with a total of 54 property tax accounts have applied for 2022 property tax exemptions under the. the city of regina offers grants up to $50,000 and property tax exemptions up to 5 years for eligible intensification and revitalization.

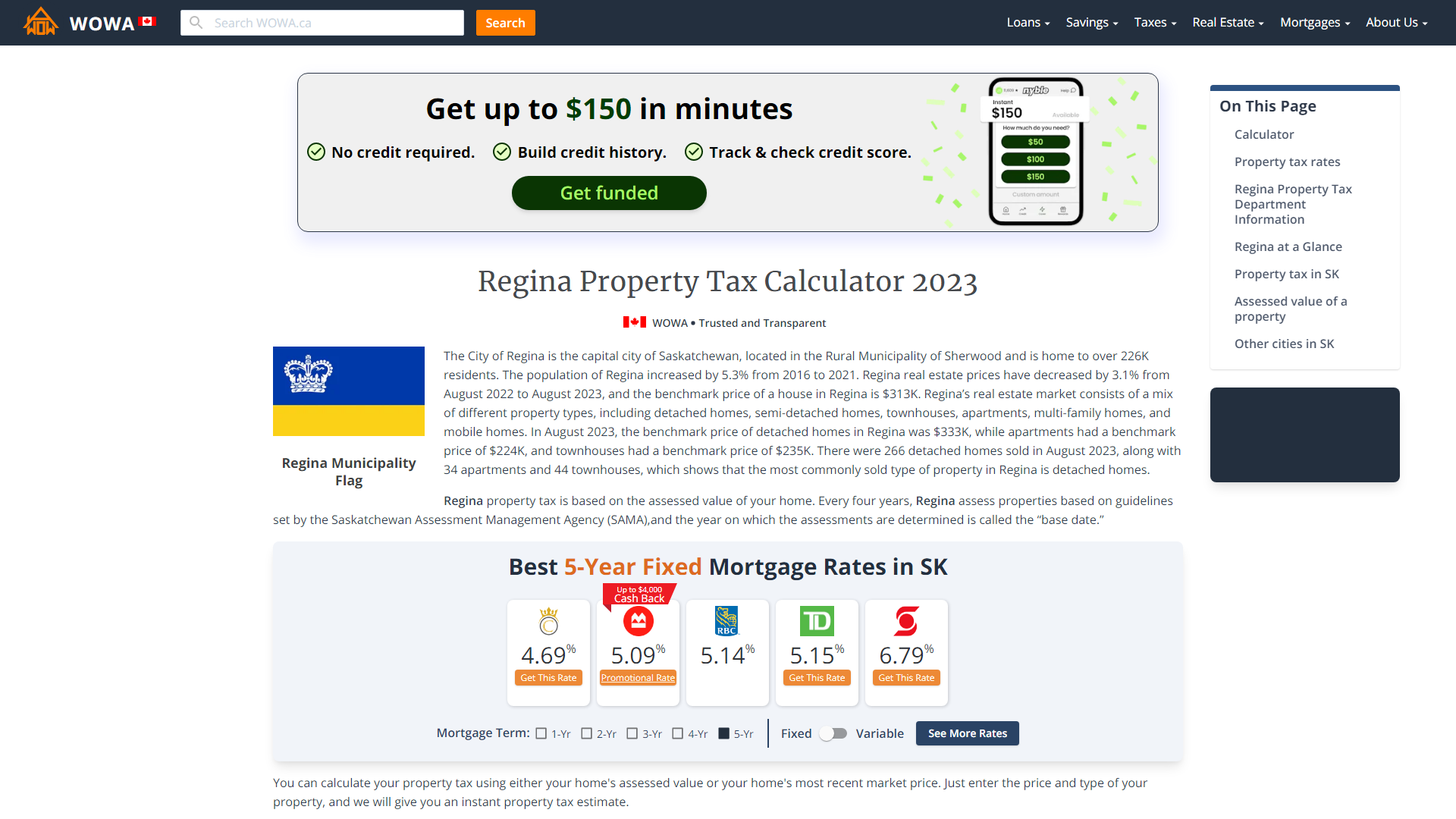

from wowa.ca

the city of regina offers grants up to $50,000 and property tax exemptions up to 5 years for eligible intensification and revitalization. 34 organizations with a total of 54 property tax accounts have applied for 2022 property tax exemptions under the. the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. the bylaw provides a tax exemption for the years 2020 to 2024 for the property located at 5380 parliament avenue, regina, sk. The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification.

Regina Property Tax 2023 Calculator & Rates WOWA.ca

City Of Regina Property Tax Exemption Program regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification. regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification. the city of regina offers grants up to $50,000 and property tax exemptions up to 5 years for eligible intensification and revitalization. The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. 34 organizations with a total of 54 property tax accounts have applied for 2022 property tax exemptions under the. the bylaw provides a tax exemption for the years 2020 to 2024 for the property located at 5380 parliament avenue, regina, sk. the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of.

From assessor-property-tax-exemption-program-clarkcountywa.hub.arcgis.com

Apply Now! City Of Regina Property Tax Exemption Program The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. the city of regina offers grants up to $50,000 and property tax exemptions. City Of Regina Property Tax Exemption Program.

From www.cjme.com

Regina tax deadline is end of Thursday 980 CJME City Of Regina Property Tax Exemption Program The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. the bylaw provides a tax exemption for the years 2020 to 2024 for. City Of Regina Property Tax Exemption Program.

From www.brickandbeamdetroit.com

PROPERTY TAX EXEMPTION Brick + Beam Detroit City Of Regina Property Tax Exemption Program the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. the bylaw provides a tax exemption for the years 2020 to 2024 for the property located at 5380 parliament avenue, regina, sk. regina — the city of regina is offering grants up to. City Of Regina Property Tax Exemption Program.

From www.fxbaogao.com

The Property Tax Exemption for Nonprofits and Revenue Implications for City Of Regina Property Tax Exemption Program the bylaw provides a tax exemption for the years 2020 to 2024 for the property located at 5380 parliament avenue, regina, sk. regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification. The purpose of this bylaw is to provide a housing incentive tax exemption to the. City Of Regina Property Tax Exemption Program.

From www.youtube.com

Regina City Council Delegation 2017 Property Tax Exemptions YouTube City Of Regina Property Tax Exemption Program 34 organizations with a total of 54 property tax accounts have applied for 2022 property tax exemptions under the. regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification. the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of. City Of Regina Property Tax Exemption Program.

From www.firstfoundation.ca

Putting Regina's Recent Property Tax Increase Into Perspective First City Of Regina Property Tax Exemption Program 34 organizations with a total of 54 property tax accounts have applied for 2022 property tax exemptions under the. The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five. City Of Regina Property Tax Exemption Program.

From www.pdffiller.com

Fillable Online Residential Property Tax Exemption Program for Homes City Of Regina Property Tax Exemption Program the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. the bylaw provides a tax exemption for the years 2020 to 2024 for the property located at 5380 parliament avenue, regina, sk. regina — the city of regina is offering grants up to. City Of Regina Property Tax Exemption Program.

From www.townofantigonish.ca

Low Property Tax Exemption Town News City Of Regina Property Tax Exemption Program the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. the bylaw provides a tax exemption for the years 2020 to 2024 for. City Of Regina Property Tax Exemption Program.

From www.cbc.ca

Regina to allow backyard suites across entire city CBC News City Of Regina Property Tax Exemption Program regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification. the bylaw provides a tax exemption for the years 2020 to 2024 for the property located at 5380 parliament avenue, regina, sk. the city of regina offers grants up to $50,000 and property tax exemptions up. City Of Regina Property Tax Exemption Program.

From www.pdffiller.com

Fillable Online Personal Property Tax Exemption Programs for Seniors City Of Regina Property Tax Exemption Program 34 organizations with a total of 54 property tax accounts have applied for 2022 property tax exemptions under the. the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. the city of regina offers grants up to $50,000 and property tax exemptions up. City Of Regina Property Tax Exemption Program.

From www.youtube.com

City of Regina City Council Delegation Property Tax Exemption Review City Of Regina Property Tax Exemption Program The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. the city of regina offers grants up to $50,000 and property tax exemptions. City Of Regina Property Tax Exemption Program.

From www.commerce.wa.gov

MultiFamily Housing Property Tax Exemption Program Washington State City Of Regina Property Tax Exemption Program regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification. 34 organizations with a total of 54 property tax accounts have applied for 2022 property tax exemptions under the. The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties. City Of Regina Property Tax Exemption Program.

From childcarecanada.org

Licensed childcare centres seeking Regina property tax exemption City Of Regina Property Tax Exemption Program the bylaw provides a tax exemption for the years 2020 to 2024 for the property located at 5380 parliament avenue, regina, sk. regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification. the city of regina offers grants up to $50,000 and property tax exemptions up. City Of Regina Property Tax Exemption Program.

From www.youtube.com

Property Tax Exemptions for Seniors and Veterans YouTube City Of Regina Property Tax Exemption Program the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. the city of regina offers grants up to $50,000 and property tax exemptions. City Of Regina Property Tax Exemption Program.

From www.nbcrightnow.com

Property tax exemption Top Video City Of Regina Property Tax Exemption Program The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. the city of regina offers grants up to $50,000 and property tax exemptions. City Of Regina Property Tax Exemption Program.

From cekgfyqe.blob.core.windows.net

Regina City Property Tax at Carmen Hanks blog City Of Regina Property Tax Exemption Program the bylaw provides a tax exemption for the years 2020 to 2024 for the property located at 5380 parliament avenue, regina, sk. 34 organizations with a total of 54 property tax accounts have applied for 2022 property tax exemptions under the. The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of. City Of Regina Property Tax Exemption Program.

From www.formsbank.com

Fillable Short Form Property Tax Exemption For Seniors 2017 City Of Regina Property Tax Exemption Program regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification. The purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under. the purpose of this bylaw is to provide a housing incentive tax exemption to the owners. City Of Regina Property Tax Exemption Program.

From ottawacitizen.com

City of Regina to issue 6month notice on outstanding property taxes City Of Regina Property Tax Exemption Program regina — the city of regina is offering grants up to $50,000 and property tax exemptions for five years for intensification. the purpose of this bylaw is to provide a housing incentive tax exemption to the owners of properties that qualify under the city of. the bylaw provides a tax exemption for the years 2020 to 2024. City Of Regina Property Tax Exemption Program.